This dad decided to teach his 3 y.o. daughter early how to become a successful investor and sound financial planner. So he came up with a plan which worked perfectly. Here is how he did it:

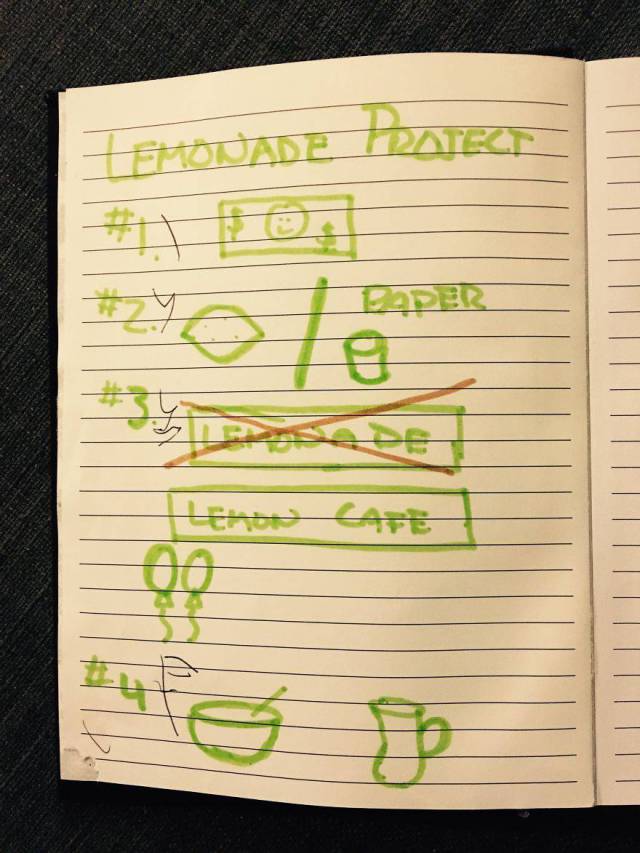

“To be able to use this strategy, my kids need to understand the following concepts (not in any particular order):

1. How to save money

2. The idea that you can invest and spend the same dollar at the same time

3. How to take out a loan and pay it back

4. How compounding interest works

To start off, I randomly decided we would work on how to take out a loan and pay it back. I figured this concept can easily be built into one of the oldest of American traditions… the good old-fashioned lemonade stand. This also gave me the ability to teach my sweet, energetic, up-for-anything-three-year-old the main concept of loans and obviously, a ton of little lessons on the way. Here is our story…“

Step 1: Making the plan

As parents we are goofy, silly, and spontaneous, but we try to emphasis the importance of making a plan. We planned out our day and then my daughter helped draw pictures of each step.

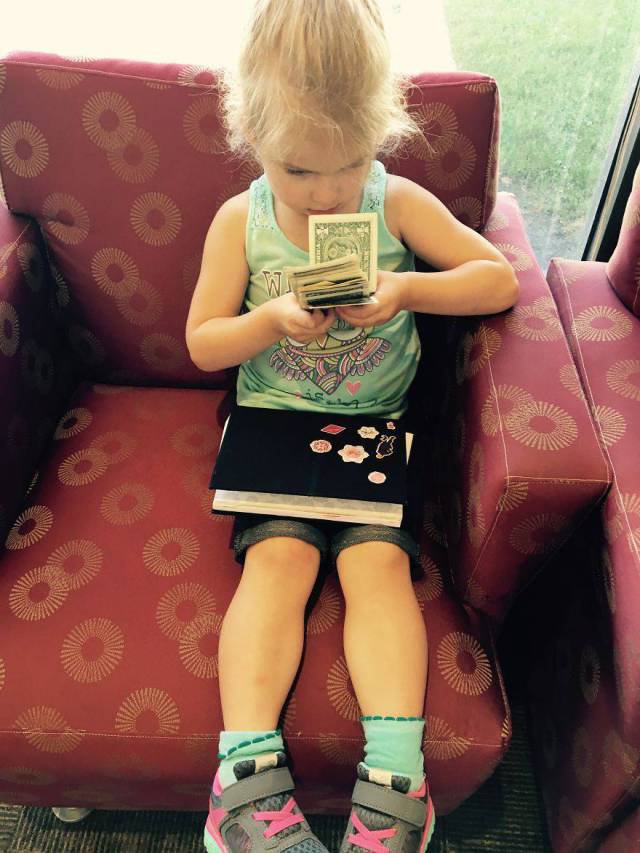

Step 2: Taking out a loan

This step was key. I wanted my daughter to see the money coming out of our bank account. She told the cashier how much money we needed (in $1 bills), then we counted the money out together. We talked about how we were borrowing the money and we would need to give it back.

Step 3: Buying supplies

As we collected our supplies, we would stop periodically to count our money (just the $1 bills). I wanted her to see the money we borrowed was slowly dwindling.

Step 4: All the hard work

We squeezed a whole lot of lemons and limes. Add some sugar, water, and a sprig of rosemary (let it sit overnight) and we were set to go.

Step 5: Selling in the shade

The next day we set up our stand and put the cuteness factor to the test. Due to state regulations, we needed to do a suggested tip instead of an actual cost. Thankfully no one took advantage of that and kept to our suggested tip.

Step 6: Paying back our loan

After we were done for the day, we went straight to the bank to repay our loan. It worked out perfectly. My daughter was a little sad, so we were able to talk about how we borrowed the money and now we were returning it. In the end she understood, but the reality hurt a little.

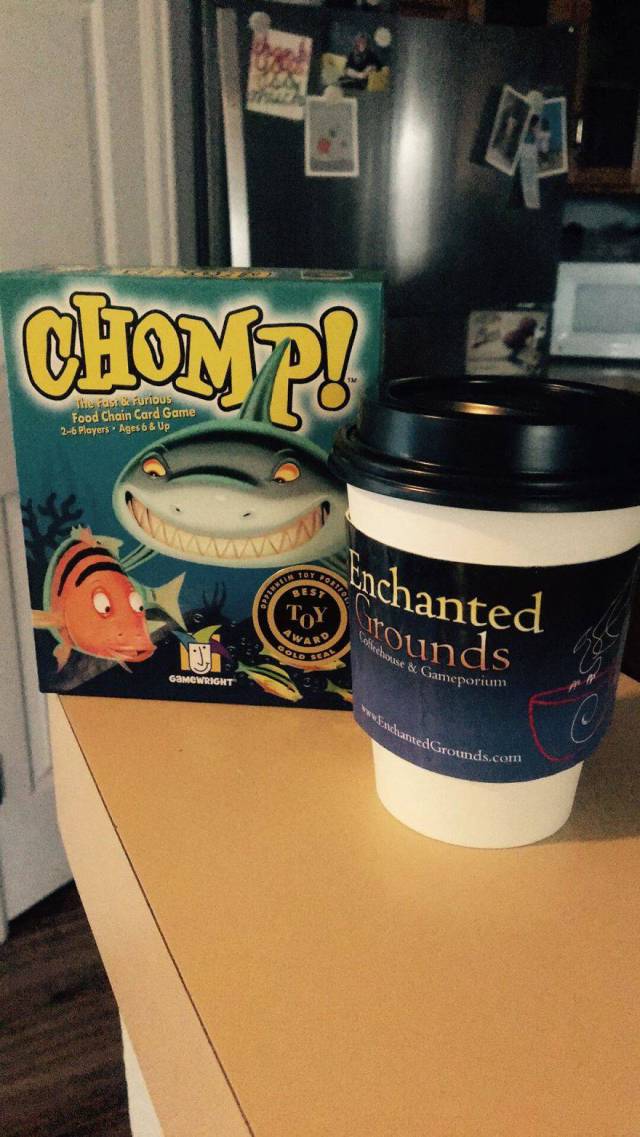

Step 7: Reaping the reward

Right after the bank, we enjoyed our reward, she bought herself a steamer and a game. The day was done and the lesson learned. Next step, now I have to figure out how to teach her that you can use the same dollar for investment and spending at the same time.