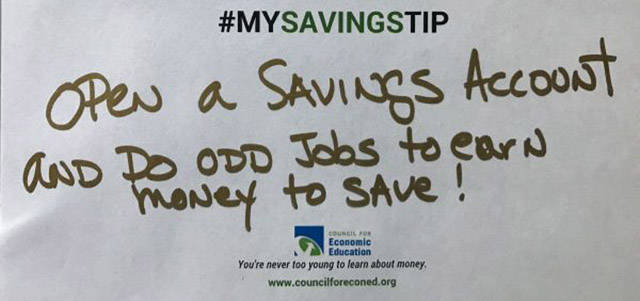

Mark Cuban, businessman, investor, owner of the Dallas Mavericks: Open a savings account and do odd jobs to earn money to save!

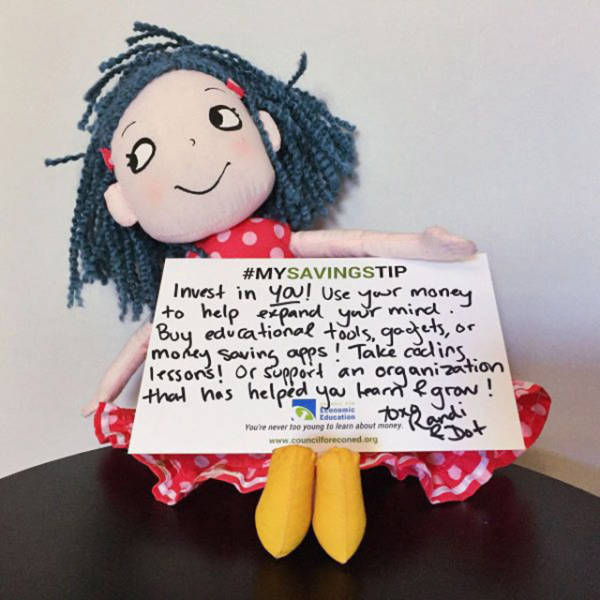

Randi Zuckerberg, entrepreneur, author and radio host: Invest in you! Use your money to help expand your mind. Buy educational tools, gadgets, or money saving apps! Take coding lessons! Or support an organization that has helped you learn and grow!

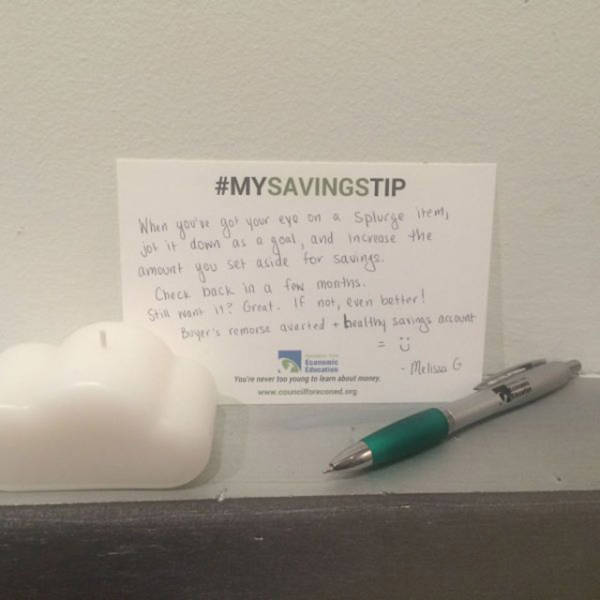

Melissa Giannini, editor-in-chief, Nylon Magazine: When you’ve got your eye on a splurge item, jot it down as a goal, and increase the amount you set aside for savings. Check back in a few months. Still want it? Great. If not, even better! Buyer’s remorse averted + healthy savings account =

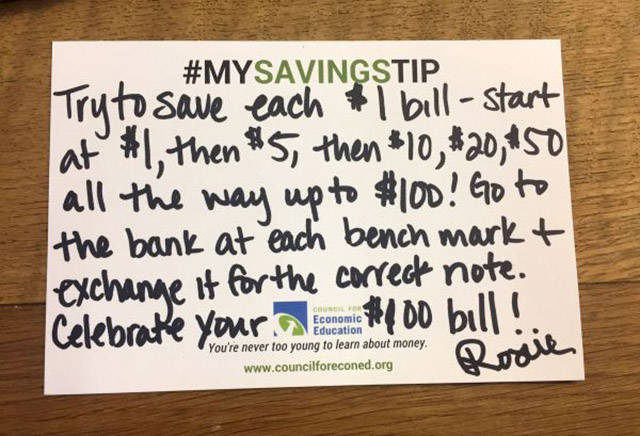

Rosie Pope, entrepreneur, maternity designer: Try to save each $1 bill — start at $1, then $5, then $10, $20, $50 all the way up to $100! Go to the bank at each benchmark and exchange it for the correct note. Celebrate your $100 bill!

Natalie Zfat, social media entrepreneur, writer: Money doesn’t grow on trees. Don’t be afraid to talk openly about the importance of saving, spending + investing.

Andrew Ross Sorkin, New York Times financial columnist and co-host of CNBC’s “Squawk Box”: If you can’t affording something, set this goal: You can buy it, but only once you’ve saved twice as much as it costs!

Annamaria Lusardi, professor of economics and accountancy at George Washington University: Spend a little time each week going over your personal finances and educating yourself about personal finance — you will become both knowledgeable and rich!

Beth Kobliner, personal finance expert and bestselling author: Start saving when you are young! If you save a quarter a day start at age 10 in a basic investment, you could end up with more than $50,000 by the time you stop working!

Carrie Schwab-Pomerantz, financial literacy advocate and president of the Charles Schwab foundation: Always comparison shop. A little extra legwork to find a lower price could end up saving you a lot of money in the long run.

Ron Lieber, “Your Money” columnist for the New York Times:

Doing things > Having things

Your spending = Your values