• Don't insult other visitors. Offensive comments will be deleted without warning.

• Comments are accepted in English only.

• No swearing words in comments, otherwise such comments will be censored.

• Your nickname and avatar are randomly selected. If you don't post comments for 7 days, they both are reset.

• To choose another avatar, click the ‘Random avatar’ link.

its Uranus!

So according to that formula, you would pay $300 in taxes, or just over 2%. Meaning you pay nearly 15x *less* in taxes. But yeah, go ahead and whine about it.

My guess is that at that income level you have nothing to offer an employer that is worth more so s#ck it

this is grossly oversimplified and shown one aspect using a tax table. im not familiar with UK but in US there are any number of things that can lower or raise your taxes paid besides just "wages"

In Eastern Europe they get payed in cache. No taxes for cache, because there is no trace of cache.

Right, we should have a flat tax instead. Everyone pays 18%. No deductions.

Those who earn 100k it's not a problem. This post is about understanding how tax rates work. A lot of people think if they work more the tax office will take more than they make extra because "they will have to pay 40% tax on everything".

May someone explain to me what's going on?

Windows Media Player

They use windows media player... in WW II?

This movie is supposed to play in 1940 - 1945. Yet on the screen you see the buttons of a software media player.

Makes perfect sense... the NAZI's invented Windows.

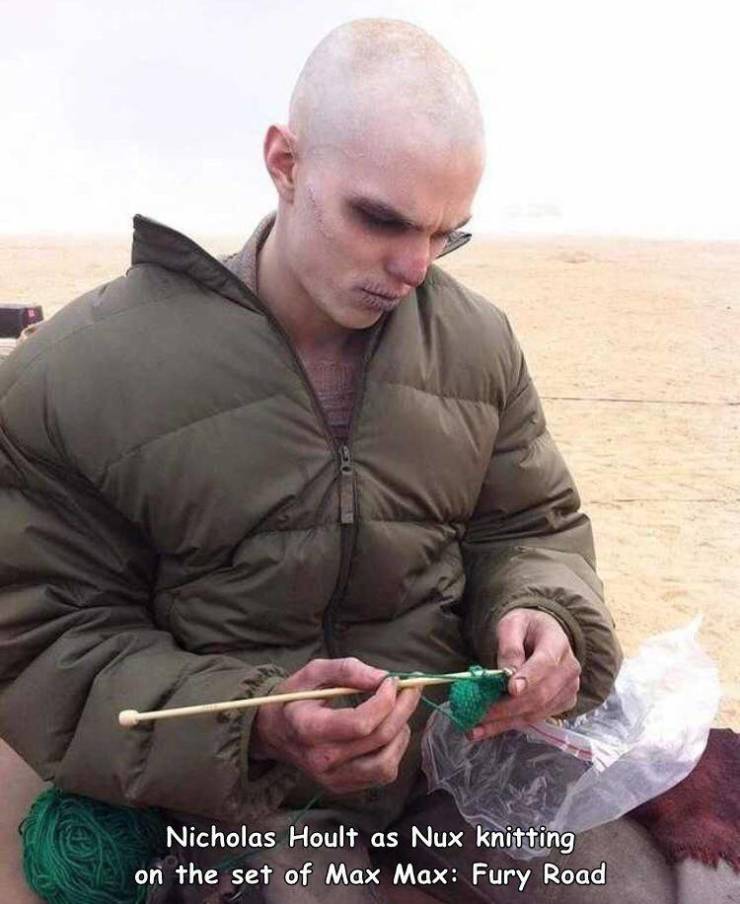

Now you're just knit picking.

Taxation is not stealing. But I can understand, that sometimes it feels like stealing. This money should be used to build or do something whereof everybody can profit (funding schools for example). But if you here what politicians do sometimes, being a criminal themselves, it feels like stealing. A solution might be to go into politics yourself and don't be corrupt.

*hear

how about stuff you buy, taxs on sales, buyer funds it with taxed money.?

Hey, well... don't forget about state tax (additional 8% in NY), sales tax (additional 8% on all purchases in NY). Other local taxes if you live in a village etc. Gas tax, soda tax, cigarette tax, alcohol tax, death tax, tolls roads, property tax... So, in the end if you live in NY you still pay over 50% of all your money in taxes.

That's right. There are a lot other taxes. In Germany you pay 19% tax on everything you buy except food (food is 7%). New TV for 500€ -> 95€ tax. That's a lot in my opinion.