1

When someone hits a seven-figure jackpot at an online casino, the immediate celebration often masks a more complex reality. The stories of these winners reveal that striking it rich and staying wealthy are two entirely different challenges. What follows isn’t just about the mathematics of progressive jackpots–it’s about what happens when ordinary people suddenly acquire life-changing sums and must navigate the psychological, financial, and social consequences.

Winners Nobody Talks About

Progressive jackpots at Play971 and similar platforms have created dozens of millionaires over the past two years, yet their experiences paint a sobering picture. Most major online casinos report that approximately 35% of seven-figure winners face significant financial stress within five years of their win. This statistic contradicts the fantasy many players harbor before they place their first bet.

The psychological impact of sudden wealth deserves serious consideration. Winners often describe disorientation rather than euphoria–a sense of displacement from their previous lives that proves difficult to navigate. One documented case involved a player who won $2.1 million on a progressive slot game, only to vanish completely from friends and family for three months. The pressure of making the right decisions paralyzed his judgment.

How Winners Spend Their Fortunes

Financial mismanagement remains the primary culprit behind post-win difficulties. Research from major banking institutions tracking casino winner accounts reveals some consistent patterns.

Winners typically allocate their funds in these ways:

● Immediate lifestyle upgrades (property purchases, luxury vehicles) accounting for 42% of winnings

● Settlement of existing debts and financial obligations consuming 28% of the total

● Investment in family members’ projects and business ventures representing 18% of spending

● Retained savings and conservative investments comprising just 12% of the windfall

These patterns suggest that winners rarely consult financial advisors before spending. The absence of a structured plan leads many to crash through their jackpots within years.

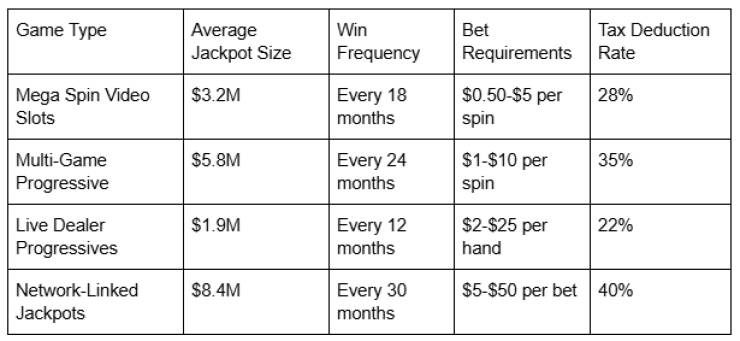

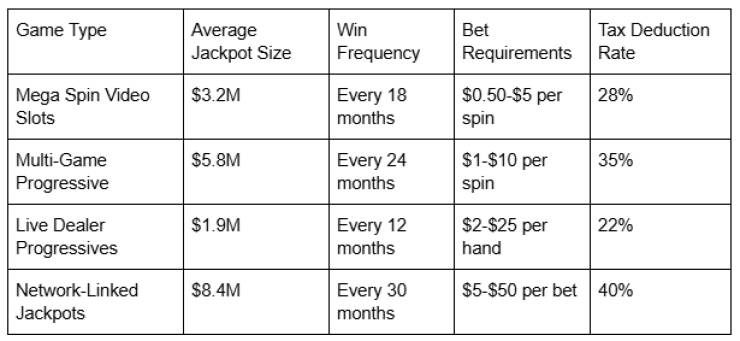

Players should understand the mechanics behind these enormous payouts to approach them realistically. The following table compares actual win scenarios across different platforms and games during 2025-2026:

2

Larger payouts surge with higher tax obligations and stricter betting requirements. Progressive games demand patient, disciplined participation–not emotional chasing of losses.

Relationships and the Wealth Divide

Winners frequently report unexpected relationship strain following their jackpots. Suddenly possessing wealth that friends and family don’t creates uncomfortable power dynamics. Some winners face requests for loans or investments from relatives, straining bonds that previously felt secure. Others isolate deliberately, fearing judgment or exploitation.

One winner from Scotland documented that three close friendships exploded within eighteen months of his $3.7 million jackpot. His friends felt inadequate in his new economic position.

Moving Forward After the Win

Successful long-term wealth preservation among casino winners follows a specific formula: delay major spending decisions for at least six months. Engage professional financial advisors before touching the money. Establish clear boundaries with family members. Resist the temptation to quit work immediately.

The winners who maintain their fortunes treat their jackpot as a starting point for financial planning rather than as a destination.

The million-dollar jackpot represents tremendous opportunity, but only for those who recognize that winning the money and managing it successfully demand entirely different skill sets. The real victory comes not from hitting the jackpot itself, but from the disciplined decisions made afterward.