• Don't insult other visitors. Offensive comments will be deleted without warning.

• Comments are accepted in English only.

• No swearing words in comments, otherwise such comments will be censored.

• Your nickname and avatar are randomly selected. If you don't post comments for 7 days, they both are reset.

• To choose another avatar, click the ‘Random avatar’ link.

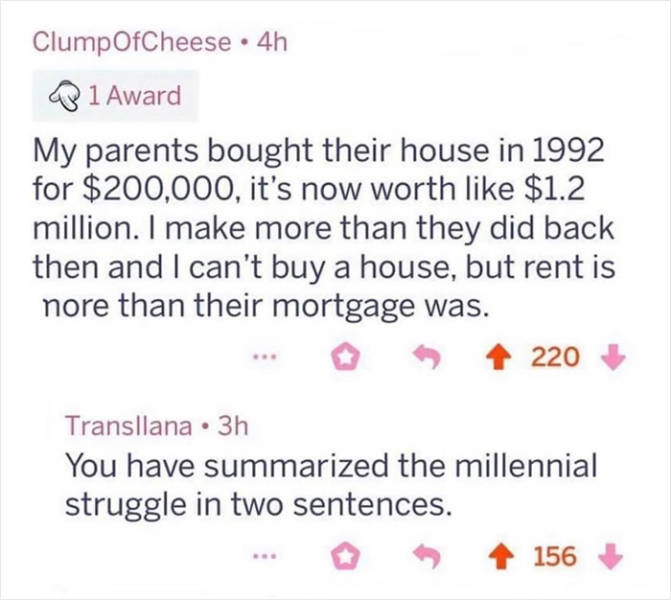

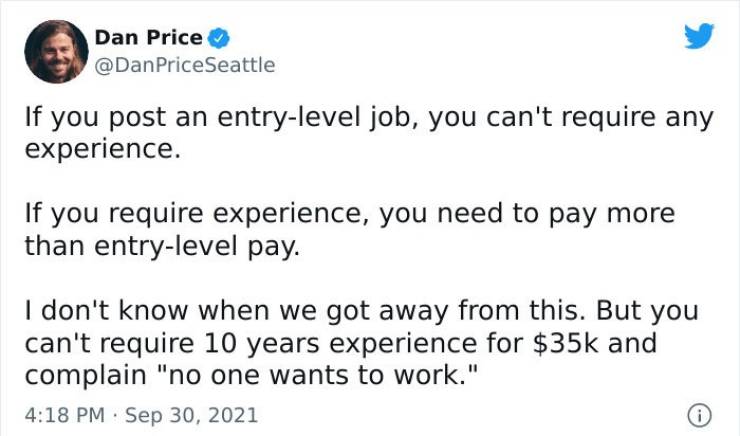

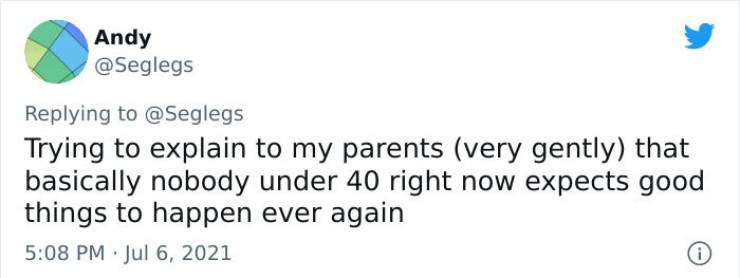

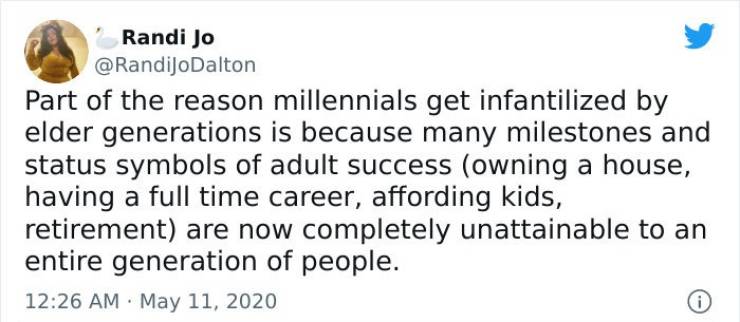

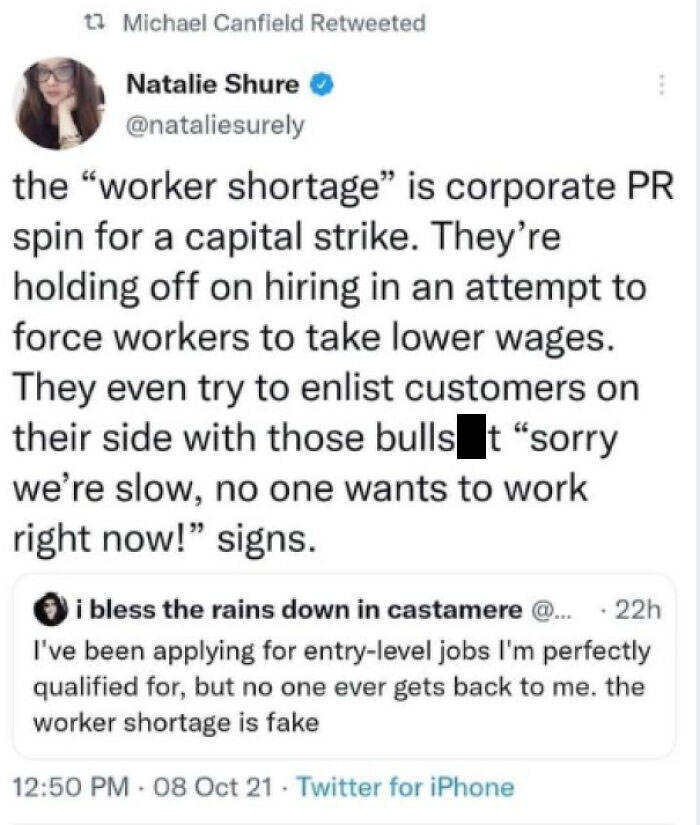

I bought a house at 34 (on the California coast), work 8 hour days with some overtime, am saving for retirement, and am on a path to support a family on 1 income next year. The likely difference: I didn't go to college, so I don't have unaffordable debt, and I chose a field that I knew would pay well (telco).

You reap the benefits and costs of your own choices.

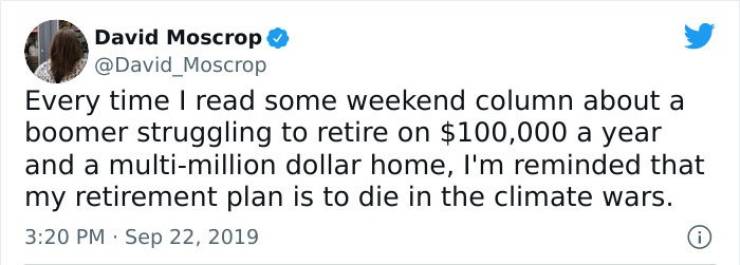

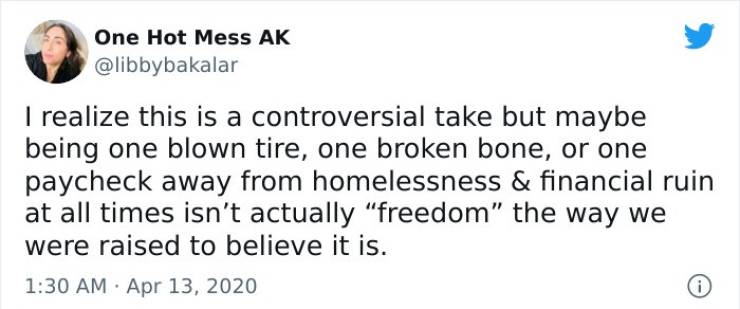

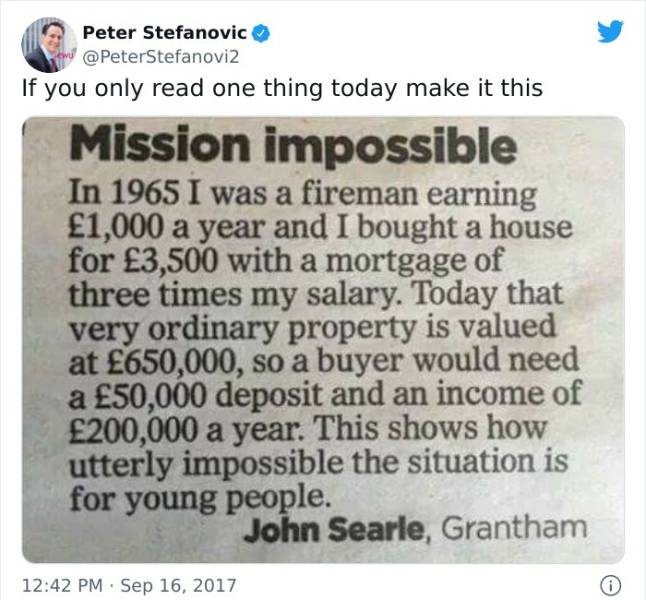

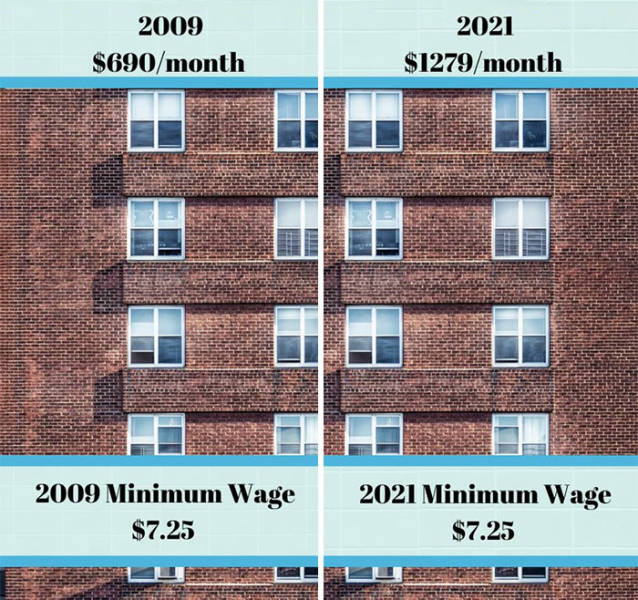

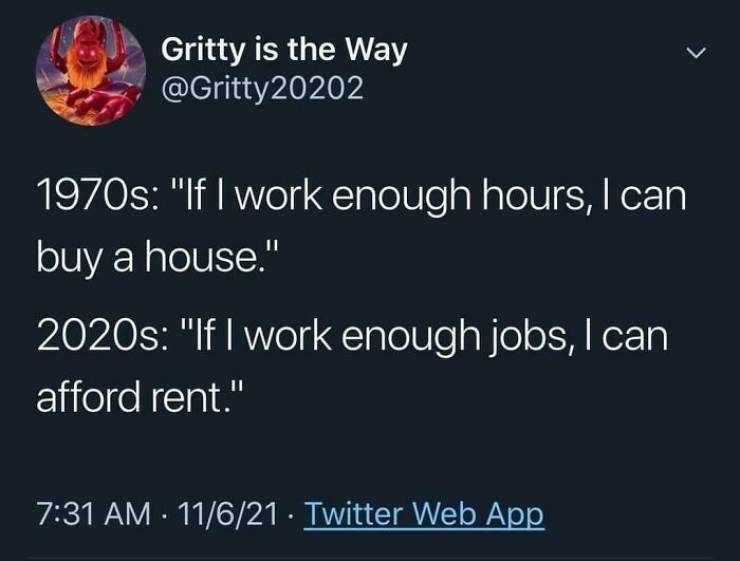

When you buy a home the world opens up to you. Your mortgage repayments become equity. Your house can out-earn you in some markets (mine earned 3x my salary in the past year, and I have a decent salary).

When you rent, you have no equity. Any capital gains are earned by the property owner. If I did not own my house, I couldn't afford to buy it now, and given its price is increasing at a rate 3x my salary in a year, there's no way I could afford it next year even if I saved every single cent I earn.

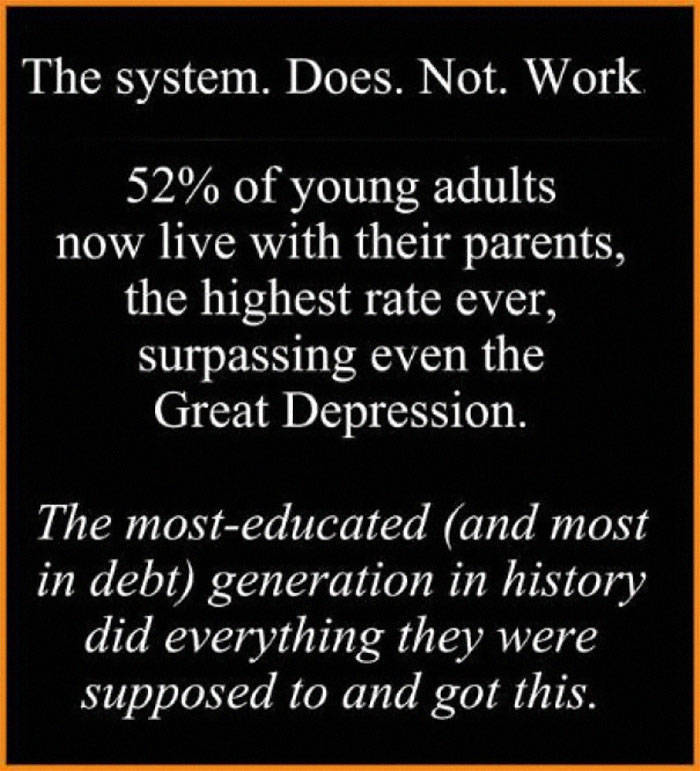

You got in early - good for you. But don't pretend the same situation applies to others.